- Jun 27, 2016

- 150

- 40

- 113

- Twitter Username

- @irenerellish_

- Tumblr Username

- irellish

- Chaturbate Username

- shemalesissy2

- ManyVids URL

- https://www.manyvids.com/Profile/12/irenerellish/

Hello.

I write here hoping that, all together, can understand better what will be reported to EU countries authorities.

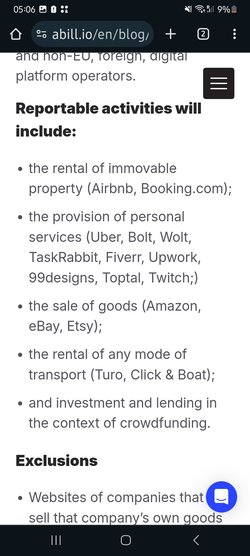

From 31 january 2024, the DAC7 law will be active in europe and all digital platforms will be obligated to report to countries informations about models and their earnings.

Only if :

- more than 2000€

- more than 30 transactions

Now… chaturbate didnt ask anything about filling some form in the last month!

I have just written to support, but as usual CB support is the worst all over the world and they answer simply “yes we provided all needed informations in accordance with dac7 law”

Ok but.. I asked them, for example, what means 30 transaction in chaturbate?

30 transactions= 30 invoices?

I suppose yes..

Couldnt believe that 1 transaction is 1 tip.

Until the token will be not cashout and converted into $ I think that dont count as transaction and amount.

Rigth?

What do you think about?

Its incredible that a site as CB doesnt explain NOTHING! and doesnt support models

@punker barbie maybe can help us about dac7 law for chaturbate I hope.

I feel really disappointed

(Apologizes for not perfect english)

I write here hoping that, all together, can understand better what will be reported to EU countries authorities.

From 31 january 2024, the DAC7 law will be active in europe and all digital platforms will be obligated to report to countries informations about models and their earnings.

Only if :

- more than 2000€

- more than 30 transactions

Now… chaturbate didnt ask anything about filling some form in the last month!

I have just written to support, but as usual CB support is the worst all over the world and they answer simply “yes we provided all needed informations in accordance with dac7 law”

Ok but.. I asked them, for example, what means 30 transaction in chaturbate?

30 transactions= 30 invoices?

I suppose yes..

Couldnt believe that 1 transaction is 1 tip.

Until the token will be not cashout and converted into $ I think that dont count as transaction and amount.

Rigth?

What do you think about?

Its incredible that a site as CB doesnt explain NOTHING! and doesnt support models

@punker barbie maybe can help us about dac7 law for chaturbate I hope.

I feel really disappointed

(Apologizes for not perfect english)